Calculate depreciation of house

A tax depreciation schedule from BMT helps all residential investment property owners claim maximum property tax depreciation deductions. Whether you are thinking about replacing your old appliances like a washing machine or dealing with a home insurance policy that offers replacement cash value or actual cash value this calculator has got you covered.

Depreciation Schedule Formula And Calculator

Next add in the cost of major improvements for example additions or upgrades.

. You buy a rental property on May 15. This Is What Happens When The Market Value Of A Property Falls How to calculate depreciation of property. The amount of Re.

The following article will explain the. Here we discuss how to calculate depreciation along with step-by-step examples. Amortization is the practice of spreading an intangible assets cost over that assets useful.

To calculate the depreciation of building component take out the ratio of years of construction and total age of the building. 65000- and as agreed earlier the tenant again agrees to share 50 of the cost. The ATO has decided that after May 2017 depreciation on an investment residential property cant the deducted from income tax.

Without Section 1250 strategic house-flippers could buy property quickly write off a portion of it and then sell it for a profit without giving the IRS their fair share. Amortization and depreciation are two methods of calculating the value for business assets over time. 7 Surprising Signs Youre Buying a House Youll Slowly Come To Hate.

Basically it recognises that the building itself plus its internal furnishings and fittings will become worn over time and eventually need to be replaced. Calculate what balance amount the tenant would have to pay the prevailing rate of interest being 10. Begin by noting the cost of the original investment that you made in your property.

Can you Avoid Depreciation Recapture Taxes. Select Property Type Construction Type Quality of Finish Floor Area Estimated year of Construction Year of Purchase and the Closest Major City to your property then click Calculate. The owner fails to repair the house in two years and the cost of repairs rises to Rs.

So in our example Marks property was last assessed at 120000 and the assessor valued the house at 90000 75 of value. A house may sell for 250000 but the rebuild cost may be 120000 and the latter amount is what underwriting is going to cover Most insurance companies will write a policy for a higher amount than the calculated replacement cost value at your request but its not necessary. Storage costs include all costs associated with physically storing your inventory such as warehousing or storage rent utilities and insurance.

To calculate your adjusted basis. Assume a depreciation rate of 30 after the first year and 20 each consecutive year. 1- at 10 interest will grow to.

Calculating inventory holding cost is relatively easy as long as youve determined your storage employee opportunity and depreciation costs. Therefore the land was valued at 30000 25. There are however a few things to keep in mind.

Heres an example. The results will display the minimum and maximum depreciation deductions that may be available for your investment property between 1 and 5 full years. It allows you to claim a tax deduction for the wear and tear over time on most old or new investment properties.

A 1031 exchange could be used in former times for a wider range of asset classes but with the passing of the Tax Cuts and Jobs Act TCJA only. How to calculate property depreciation. Samples that can reduce your cost basis include.

This method of calculating the depreciation of an asset assumes that it depreciates uniformly in value over its effective life. Point Should Be Know Before Estimating Concrete Quantity Density of Cement 1440 kgm3 Sand Density 1450-1500 kgm3 Density of Aggregate 1450-1550 kgm3 How many KG in 1 bag of cement 50 kg Cement quantity in litres in 1 bag of cement 347 litres. To use this method the following calculation is used.

For updates on our response to COVID-19. After working on the house for several months you have it ready to rent on July 15 so you begin to advertise online and in the local papers. How to calculate depreciation for real estate can be a head-spinning concept for real estate investors.

A new house purchased for 730000. You need to perform something called a 1031 exchange which allows you to take the proceeds from the sale of an asset and roll them into a similar asset. Yes you most certainly can.

To calculate the impact of depreciation compare an example for a commercial truck worth 100000. Here the vehicle you originally paid 100000 for is worth only 28672 after five years not even 30 of its initial value. For an independent house the average lifespan of any building is 60 years.

So if you use an accelerated depreciation method then sell the property at a profit the IRS makes an. If the investor uses a depreciation schedule for the property they can partly deduct most future replacements and repairs yearly. Depreciation is a tax deduction available to property investors.

Property owners have two ways of calculating depreciation on their assets. Section 1250 helps protect against this kind of tax avoidance. The appliance depreciation calculator estimates the actual cash value of any home appliances that you own.

Then subtract any amounts allowed via depreciation or casualty and theft losses. How to calculate your inventory holding cost. Calculate the after-tax holding costs for any property.

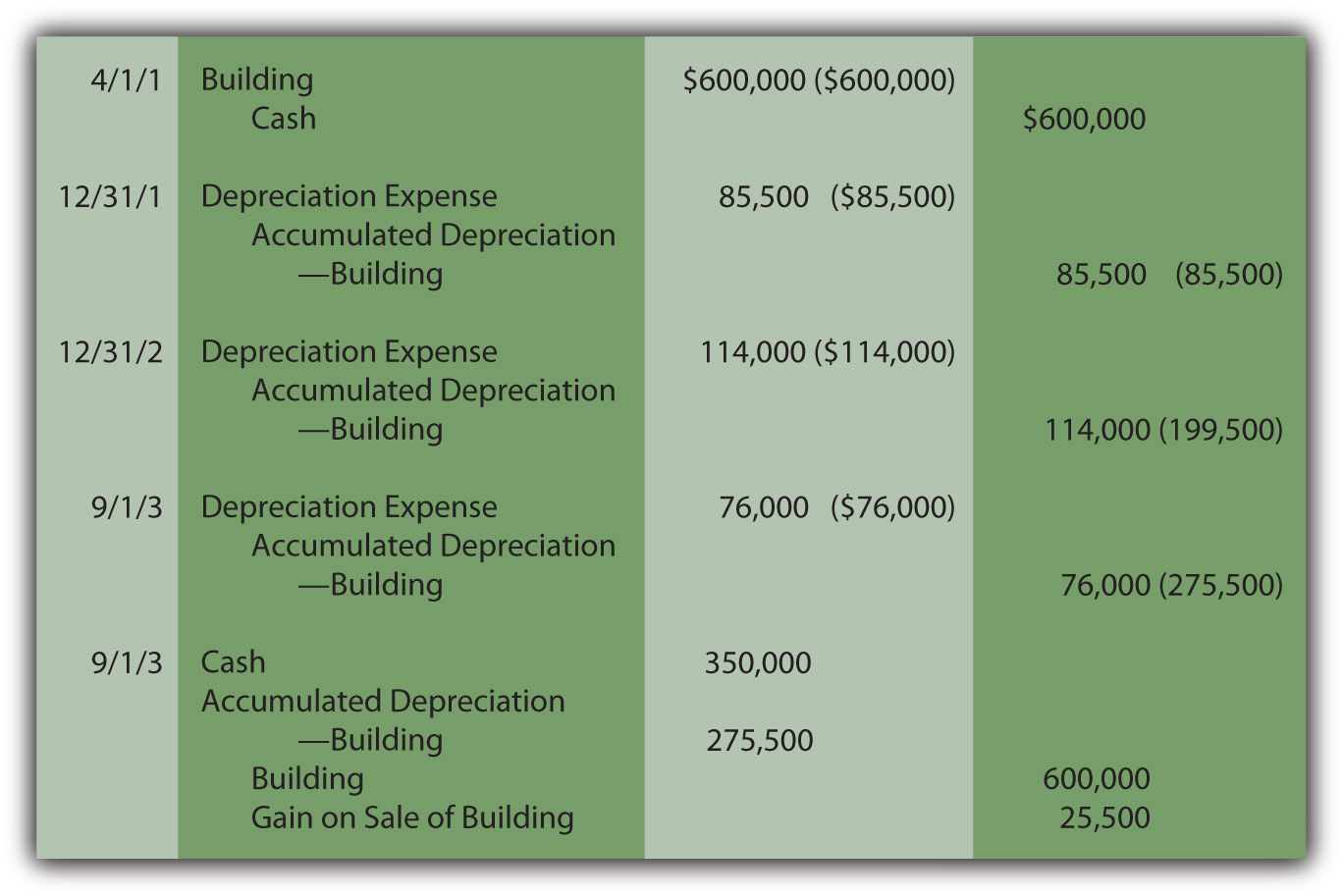

10 3 Recording Depreciation Expense For A Partial Year Financial Accounting

Depreciation Formula Calculate Depreciation Expense

How To Calculate Property Depreciation

Straight Line Depreciation Calculator And Definition Retipster

Depreciation Formula Calculate Depreciation Expense

How To Use Rental Property Depreciation To Your Advantage

What Is Property Building Depreciation Rate And How To Calculate It

Methods To Calculate Property Depreciation Building Costing And Estimation Civil Engineering Projects

Depreciation Of Building Definition Examples How To Calculate

Calculating Depreciation Youtube

What Is Property Building Depreciation Rate And How To Calculate It

Depreciation Schedule Formula And Calculator

How To Calculate Depreciation Expense For Business

Appreciation Depreciation Calculator Salecalc Com

Depreciation Formula Calculate Depreciation Expense

Straight Line Depreciation Calculator And Definition Retipster

How To Calculate Depreciation Of Property